Improving your credit score is a bit like getting in shape – it takes dedication and consistency over time to see real results. And just as tracking calorie intake is critical for weight loss, monitoring your credit utilization rate is key for credit scoring gains.

But what exactly is this mysterious credit utilization rate metric? And why does it matter so much? Read on, dear reader, and reveal its secrets!

Understanding Credit Utilization Rate

Let’s start with the basics, shall we?

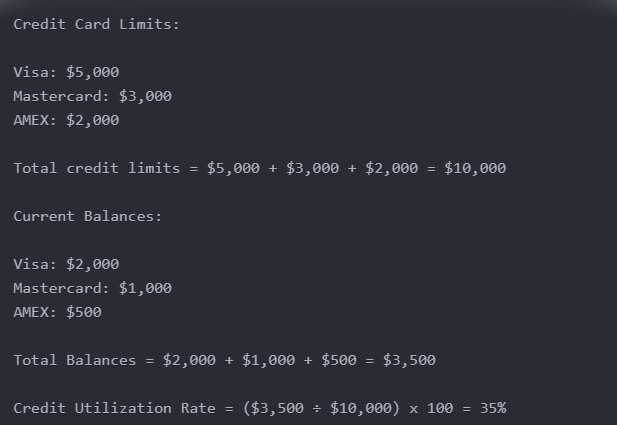

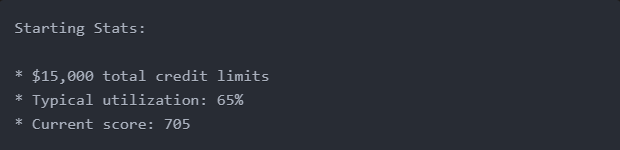

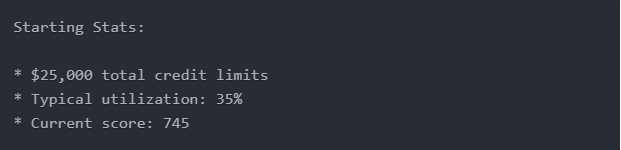

Your credit utilization rate refers to the percentage of your total available revolving credit card limits that you’re actually using at any given time. Specifically, it’s calculated as:

Credit Utilization Rate = (Total Balances on Credit Cards) ÷ (Total Credit Limits) x 100

For example:

As a general rule, try to keep your credit utilization below 30%. The lower you can get it, the better for your credit score.

But why does this metric matter so much in determining your score? Let’s dig deeper…

Heavy Credit Usage Signals Risk

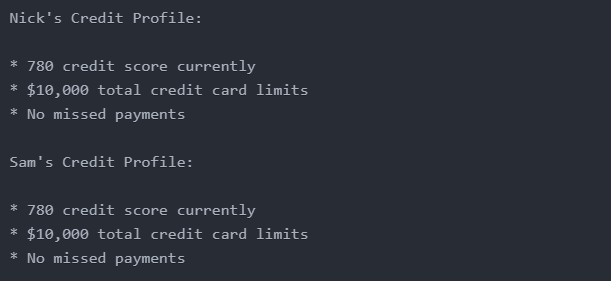

Imagine two friends – Nick maintains a sub-10% credit utilization rate every month, while Sam always carries balances around 80% of his total limits.

Who would you view as more creditworthy – Nick or Sam?

Chances are your gut says Nick. And credit scoring models would agree.

High credit utilization signals potential risk in a few key ways:

- Financial stability – Higher balances indicate Nick may struggle with cash flow to pay his bills.

- Over-reliance on credit – Nick depends heavily on credit instead of cash to fund his lifestyle.

- Higher default risk – Maxed-out cards mean one income disruption could spell default.

Meanwhile, Nick’s low utilization puts him in the “responsible credit user” camp. He proves every month that he can handle credit wisely.

The “Credit Utilization” Effect

Remember – credit utilization refers to revolving credit lines like credit cards, NOT installment loans like mortgages or auto loans. Cards have flexible limits that can change month-to-month, whereas installment loans offer fixed limits.

Now, watch what happens to Nick and Sam’s credit scores as they carry different utilization rates:

Month 1:

- Nick – $1,000 balance ($10% utilization)

- Sam – $8,000 balance (80% utilization)

Month 1 Scores:

- Nick – 785

- Sam – 720

Month 2:

- Nick – $500 balance (5% utilization)

- Sam – $500 balance (5% utilization)

Month 2 Scores:

- Nick – 790

- Sam – 780

Despite identical profiles initially, a lower utilization rate boosts Nick’s score significantly! Even one month of lower usage starts improving Sam’s credit as well.

Key Takeaways on Utilization Rate

- Lower percentage = higher score

- Monitored heavily by credit bureaus

- Fluctuates card-to-card each month

- Often accounts for 30%+ of your score

- Rapidly adjustable with new payment habits

6 Tips for Improving Your Credit Utilization Rate

Convinced that credit utilization matters now? Let’s talk about some ways to start improving that rate!

Copy code

Pro Tip: Experts recommend not using more than 30% of your total available credit limits per month, and even less is better!

1. Know Your Limits

This one seems obvious – but you’d be shocked how many people don’t actually know their credit limits offhand! Log into your credit card accounts and tally up:

- Total combined credit limits

- Total current balances

- Calculate your utilization percentage

Knowing your stats is step #1.

2. Pay Down Balances

Here’s an easy way to rapidly reduce utilization – funnel extra money toward paying down credit card balances.

Aim to get balances on each card below 30% of that individual limit, by making larger monthly payments.

Tip: Attack the highest-interest cards first with surplus cash flow!

3. Increase Credit Limits

Another way to shrink utilization is increasing those denominator credit limits! Consider requesting higher limits on cards with:

- Responsible history

- Frequent usage

- Low limits relative to other cards

But beware – doing this too often can ding your credit with hard inquiries. Use limit increase requests judiciously!

4. Balance Transfer to Low-Rate Card

If you’re struggling with sky-high interest payments, see if you qualify for a 0% balance transfer offer. Move select balances to this new card and attack principal payment.

Aim to pay off transferred amounts before the 0% intro period ends – or that interest shot can be brutal!

5. Optimize Payment Timing

Did you know credit bureaus report your monthly balance based on your statement closing date? Time payments so that:

- As many cards as possible “close” with lower balances

- At least one card reports $0 balance

This credit utilization manipulation takes some planning but delivers results!

6. Open a New Card

We just talked about how credit inquiries can damage your score. But another way to reduce utilization is increasing total limits – by opening a new credit card account.

This makes the most sense if:

- You already have excellent credit

- Card offers strong rewards

- You won’t ramp up more spending

Carefully consider new credit lines as part of your credit mix strategy.

See a Sudden Credit Score Spike

Review all six of these credit utilization rate tips – and pick 2-3 that seem most feasible for your financial situation.

Getting serious about lowering your utilization rate can mean a 50+ point score bump within just 1-2 monthly credit cycles.

Talk about making significant credit progress without the long slog! Start putting these techniques into practice this very month.

Then bask next quarter in that joyous “new high score” moment when you check your latest credit reports. Let the credit utilization rate boosting begin!

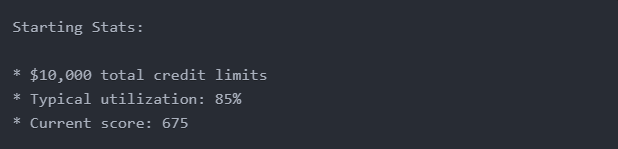

The Impact of Lower Utilization by Credit Profile

Just how much can lowering your credit card balances relative to limits help your score? Well, that depends a bit on your starting credit profile.

Check out these three consumer profiles below to estimate the potential impact:

Fair Credit (Scores 670-689)

By lowering revolving utilization to 30%, a fair credit borrower could see a score improvement around 50+ points – into the 720s!

Good Credit (Scores 690-719)

With an initially higher score and lower typical utilization, there’s still room for a good credit consumer to gain 40+ points – landing above 740!

Excellent Credit (720+)

Even consumers with great credit shouldn’t ignore utilization rate optimization. Excellent scorers may still realize a 30+ point boost – above 775!

The Bottom Line: No matter what your starting credit profile, lowering utilization opens doors to an improved credit score! Just focus first on quick wins like paying down balances.

Common Credit Utilization Rate Myths

Of course, sorting credit fact from fiction nowadays feels harder than ever! Let’s tackle (and debunk) some stubborn credit utilization myths floating around there:

Myth 1: 0% Utilization is Best

You might think paring back credit usage to absolutely nothing optimizes your score – but the opposite can happen!

FICO actually wants to see responsible usage on revolving accounts – not no usage at all.

The reality: Let at least one card report a tiny (say 5%) balance.

Myth 2: Utilization Doesn’t Change Scores Fast

Unlike other scoring factors, this one bounces around rapidly! Scores reflect each month’s new utilization reported.

See improvements in 30 days after shifting payment habits. No long lag!

Myth 3: Debt Consolidation Loans Help

It seems logically transferring high-rate balances to a lower-rate installment loan would reduce usage ratios.

But installment debts don’t influence utilization metrics for cards! Focus first on actual credit lines.

By paying attention to truths over tall tales regarding credit utilization rates, you’ve got this whole accurately strategizing for an improved score thing down!

The Lifelong Journey to Lower Utilization

Think of credit scoring as a lifelong journey – the road stretches out for (figurative) miles ahead! Here is a high-level timeline:

Ages 18-24: Open your first tradelines! Use starter credit wisely while building history.

Ages 25-34: Grow your limits and keep utilization low as expenses increase. Those card balances creep up over time!

Ages 35-44: Maintain good behaviors even as homes/cars enter budgets.

Ages 45-54: Continue balance diligence as prime borrowing years settle in. Enjoy great rates!

Ages 55-64: Pay down debts as retirement approaches. Credit needs soon decrease.

At any age, lower utilization means credit success easier attained! Just adjust strategies over time.

Tips to Maintain Lower Utilization After Improvement

So you’ve put in the hard work slashing those scary high revolving balances! Don’t undo your credit glory days by slipping back into bad habits.

Stick with these maintenance ideas once you’ve reduced utilization rates for good:

- Automate card payments for the full monthly balance – Set it and forget it!

- Use cash-back rewards to pay down balances – Let credit cards pay themselves.

- Put occasional big purchases on 0% intro purchase cards – Spread out impact over months.

- Review reports quarterly – Don’t let balances creep back up without noticing!

- Ask for periodic credit line increases – Keep total limits ahead of higher monthly spending.

Staying diligent takes work – but preserve that hard-earned score boost for years to come!

The Path to Credit Health Includes Lower Utilization

Improving credit feels a bit overwhelming at first with so many components at play – from payment history to credit mix to inquiries and more.

But zeroing in on this one key metric – revolving account utilization rate – makes an excellent starting spot on your journey.

Why? Because this factor physically adjusts each billing cycle. You see measurable credit impacts fast after lowering utilization.

And nothing helps motivate like visible progress!

Then maintain your dedication with responsible spending behaviors for the long run. That pesky utilization rate tends to creep upwards again without diligence.

But take it month by month. Celebrate each small win and victory. Keep up motivation.

This stuff really works – so go tackle that utilization rate and witness your score climb!