Moving out of an apartment can be stressful enough without having to worry about unfair charges popping up on your credit report. From cleaning fees to damage claims, some landlords and property managers seem all too eager to stick former tenants with questionable fees.

If you’ve found bogus apartment charges on your credit report, don’t panic. You have the right to dispute those charges and get them removed. With some persistence and know-how, you can protect your credit score.

This guide will walk you through the steps to dispute incorrect apartment charges on your credit report. We’ll cover:

- Reviewing your credit report for errors

- Gathering evidence to support your dispute

- Writing an effective dispute letter

- Following up if the charges aren’t immediately removed

Let’s dig in!

Review Your Credit Report for Any Incorrect Apartment Charges

The first step is pulling your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. You can get free reports annually from each at AnnualCreditReport.com.

Carefully review your reports and look for any negative marks related to a previous apartment, such as:

- Late rent payments

- Unpaid fees/damages

- Collections accounts sent to debt collectors

- Eviction notices

Make note of any incorrect apartment-related charges, including:

- The credit bureau reporting it

- The company/landlord reporting the information

- The amount and type of charge

- The dates associated with the charge

| Charge | Credit Bureau | Company Reported By | Amount | Dates |

|---|---|---|---|---|

| Late rent fee | Experian | ABC Apartments | $30 | June 2023 |

| Cleaning fee | TransUnion | XYZ Property Management | $150 | July 2023 |

Having these details will help you dispute the charges properly.

Gather Evidence to Support Your Dispute

To effectively dispute apartment charges, you need evidence to prove your case. Try to collect as many relevant documents and records as possible, such as:

- Lease agreements: Showing no fees were owed when you moved out.

- Move-in and move-out inspections: Documenting the condition you left the apartment in.

- Receipts and cancelled checks: Proving payments made, including rent and fees.

- Correspondence with landlord/management: Like letters or emails showing your attempts to resolve disputes over damages or fees.

- Photos/videos: Demonstrating the condition of the apartment when you moved in and out.

The more proof you have that the charges are illegitimate, the better. Keep detailed records of all communication with your former landlord or property manager related to the disputed charges.

Dispute the Incorrect Charges in Writing

Once you’ve gathered your evidence, it’s time to begin the formal dispute process. This involves writing a detailed letter to each credit bureau reporting the erroneous apartment charges.

The dispute letter should include:

- Your full name, address, and date of birth

- Statement that you are disputing inaccurate information on your credit report

- Applicable credit report account numbers

- Identification of each disputed charge and explanation of why it is inaccurate

- Request for the charge(s) to be removed or corrected

- Copies of any supporting documentation, circled and referenced in the letter

- Request for an updated copy of your credit report after reinvestigation

Send the letter by certified mail with return receipt requested. Keep a copy for your records along with the return receipt as proof it was received.

Under the Fair Credit Reporting Act (FCRA), the credit bureaus must investigate your dispute within 30 days. This may involve contacting your former landlord or property management company to verify the charges.

If the creditor cannot substantiate the debt, it must be removed from your credit report.

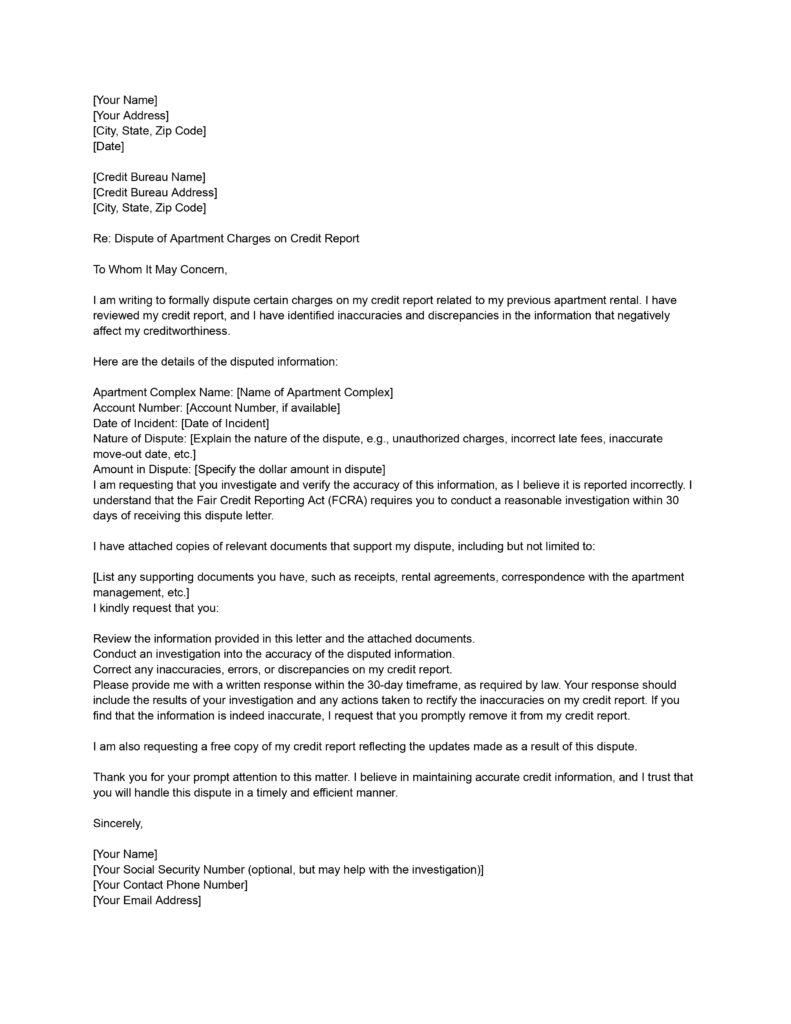

Here’s a dispute letter template you can customize:

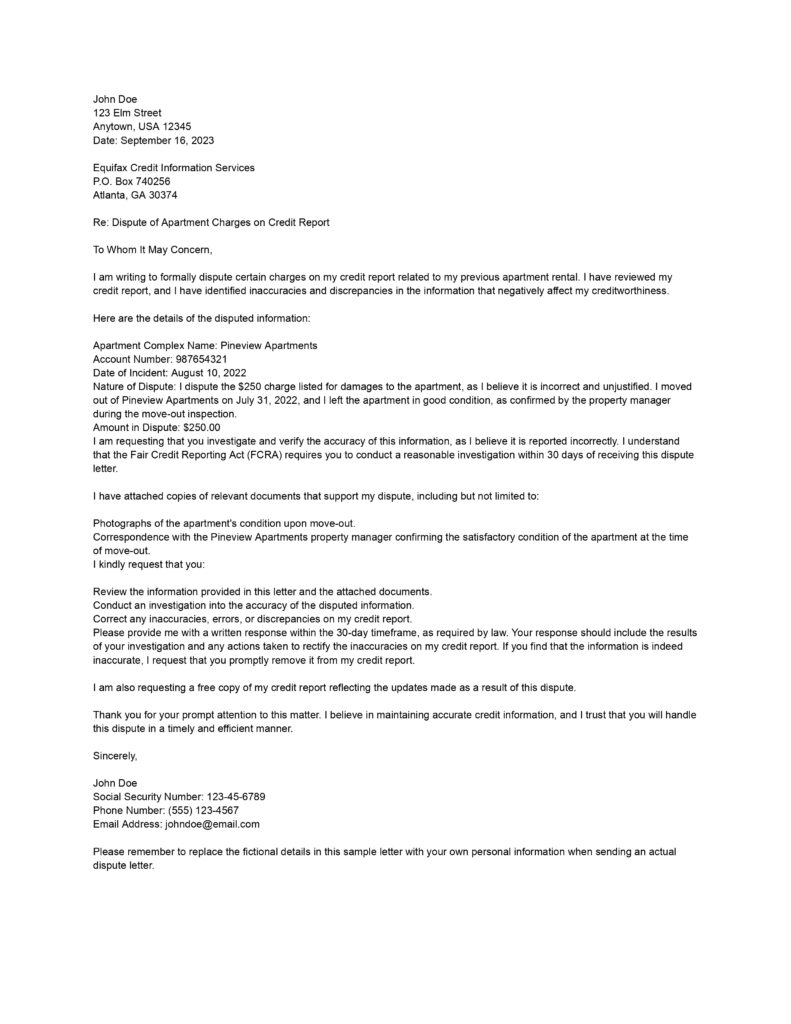

And here’s a sample dispute letter using some fictional information:

Follow Up if the Charges Aren’t Removed

If the credit bureau completes its reinvestigation and determines the apartment charges should remain, don’t give up. You have options:

- Request an explanation: The credit bureau must provide the reason why it verified the charge. Review this and determine if you have additional evidence to refute it.

- Dispute again: Send another dispute letter if you have new evidence to counter the credit bureau’s findings. Add supporting documents not included with your original dispute.

- Try goodwill letters: Write a goodwill letter to your former landlord/property manager asking them to retract the charges with the credit bureaus out of good faith. Sometimes this can resolve otherwise sticky disputes.

- Consult a credit repair company: They have expertise in navigating complex credit report disputes. Fees range depending on services provided.

- Hire a consumer protection attorney: If you have strong evidence the charges are invalid and the credit bureau’s reinvestigation was negligent, legal representation may be warranted.

- File a complaint: You can submit a complaint with the Consumer Financial Protection Bureau or your state attorney general’s office regarding the credit bureau’s handling of your dispute.

- Wait it out: If the charges are accurate, there’s unfortunately nothing you can do other than wait patiently for them to naturally fall off your credit report (typically after 7 years). Don’t neglect other credit maintenance in the meantime.

With persistence and diligence, you can successfully remove erroneous apartment charges. Just because a charge appears on your credit report doesn’t mean it’s irreversible. You have the power to dispute it.

Recap: How to Remove Incorrect Apartment Charges From Your Credit Report

Dealing with apartment charges negatively affecting your credit doesn’t have to be a hopeless headache. Here are the key steps:

- Review your credit reports for any incorrect late fees, damages, collections, etc.

- Gather compelling evidence like lease agreements and receipts proving your case.

- Send detailed dispute letters to each credit bureau reporting the erroneous charges.

- Follow up aggressively with additional disputes or complaints if the charges aren’t immediately deleted.

- Don’t hesitate to get help from credit experts if your own disputes are unsuccessful.

While frustrating, remember this won’t permanently ruin your credit if you take action. With time and effort, you can remove the unfair charges and recover your score. Don’t let bogus apartment fees haunt your credit history!

Frequently Asked Questions

Q: How do I start disputing apartment charges on my credit report?

A: Request a free credit report, identify inaccuracies, gather evidence, and send a dispute letter to credit bureaus.

Q: Can I dispute apartment charges online?

A: Yes, many credit bureaus offer online dispute forms for convenience, but mailing a formal dispute letter is also effective.

Q: What evidence should I include in my dispute?

A: Attach documents like receipts, correspondence, and photos showing inaccuracies or proving your case.

Q: How long does the dispute process take?

A: Credit bureaus typically complete investigations within 30 days, and they will notify you of the results.

Q: Can I dispute charges even if they’re valid?

A: You can, but it may not lead to removal. Disputes should focus on correcting inaccuracies.

Q: Will disputing charges affect my credit score?

A: No, disputing charges won’t harm your credit score; it’s your right under the Fair Credit Reporting Act.

Q: Do I need a lawyer to dispute charges?

A: You can dispute charges yourself, but legal advice may be beneficial for complex cases.

Q: Can I dispute apartment charges if I already paid them?

A: Yes, if the charges are inaccurate, dispute them to correct your credit report.

Q: What if the credit bureau doesn’t resolve my dispute?

A: You can escalate the dispute by providing additional evidence and contacting regulatory agencies.

Q: Will successful disputes remove charges permanently?

A: Yes, if the investigation proves inaccuracies, the charges should be permanently removed from your credit report.